UK Sustainability Legislation

In June 2025, the UK Government released exposure drafts for the UK Sustainability Reporting Standards (UK SRS S1 and S2), which are open for consultation until 17 September 2025. These standards are designed to align with the ISSB’s IFRS S1 and S2 and will form the foundation of the UK Sustainability Disclosure Standards (UK SDS), expected to be endorsed later this year.

As reported by ESG News, key amendments include “an extension of a ‘climate-first’ relief to give companies extra time to provide disclosure on some sustainability-related risks” while removing “a relief from the IFRS standard that allows companies to publish sustainability-related disclosures at a later date than their financial statements in the first year of reporting” in order to improve ‘connectivity’ with financial statements and other narrative reporting.

The consultation includes a ‘climate-first’ approach and highlights the need for additional guidance and educational materials to support small and medium-sized enterprises (SMEs). The government acknowledges that SMEs will require tailored support to meet evolving disclosure expectations and is working with industry partners to develop practical tools and frameworks.

“Support for small and medium-sized enterprises (SMEs)” is explicitly listed as a key area in the consultation, with a focus on reducing reporting burdens while maintaining transparency” – DBT, 2025.

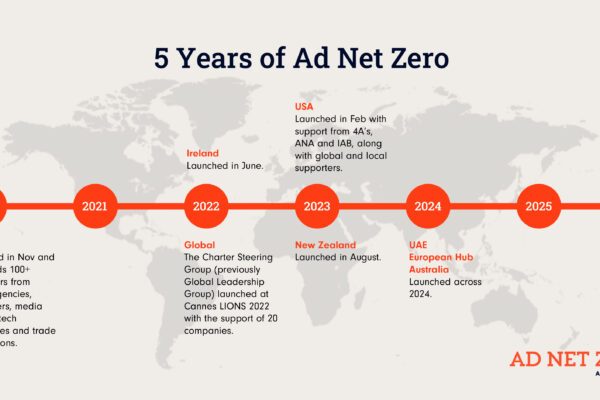

This SME focus reflects that of the Net Zero Census, supported by Ad Net Zero and many other cross-industry organisations, and run by Planet Mark and the UK Business Climate Hub, the nation’s net zero portal for small and medium sized enterprises (SMEs). The 2024 Census showed highlighted that “There is a significant opportunity to bridge the gap for smaller organisations by providing tailored financial and proficiency support.” With SME’s representing 61% of the total private sector employment in the UK in 2023, and 53% of turnover -£2.4 trillion– the opportunity of engagement with this sector of the economy is enormous.

In July 2025, the ASA reaffirmed its commitment to stricter enforcement of environmental claims under the CAP and BCAP Codes. ASA ensures that advertising is legal, decent, honest and truthful, and applies the advertising standards codes to all media formats. Many of these rules derive directly from UK consumer law, including the requirement that ads must not mislead or be likely to mislead.

The ASA also responded to the UK Government’s consultation on voluntary carbon and nature markets, clarifying that adherence to voluntary standards does not exempt advertisers from UK advertising rules.

The CMA’s updated enforcement guidance under the DMCC Act confirms that it now has direct powers to investigate and act on breaches of consumer protection law, including misleading environmental claims. While the original Green Claims Code remains a reference point, the April 2025 guidance outlines how the CMA will prioritise enforcement against unfair commercial practices, particularly those that mislead consumers.

These developments reflect a tightening regulatory environment for environmental messaging in advertising, with increased scrutiny on terms like “carbon neutral” and “net zero”.

The FCA has confirmed that companies issuing shares or bonds will need to include a summary of their climate transition plan in their prospectus, if the contents are considered material to investors. This forms part of new rules aimed at improving transparency around sustainability-labelled financial products and ensuring that environmental claims in investor communications are supported by clear, accessible information. The rules will apply from January 2026, with transitional provisions in place.

The UK Government is expected to introduce legislation regulating ESG ratings providers later this year. This follows the launch of a voluntary code of conduct supported by the FCA, aimed at improving the consistency and transparency of ESG ratings. These ratings are increasingly used in sustainability-related advertising and investor materials, and regulation is expected to strengthen trust in their use.

EU Regulation – CSRD and VSME

Ad Net Zero Europe held a session focusing on CSRD, we heard from Edouard Brocher, Sustainability Compliance Offer at IAB Europe, and Alexander Spahn, Founder at CSR Tools. The session focused on recent amendments, implementation timelines, and practical steps for preparing to comply with EU reporting.

Edouard opened by highlighting the uneven progress across member states, noting that “still nine countries, notably large markets like Germany, Netherlands, or Spain, haven’t transposed [embedded CSRD reporting into national law] yet.”

The omnibus “stop-the-clock” directive was published in the Official Journal of the European Union on 16 April 2025 and entered into force the following day. Member States have until 31 December 2025 to transpose the directive into national law.

Outlining how the stop the clock proposal has been officially adopted, Edouard went on to discuss which companies sit within which ‘wave’, and when and how they will need to report accordingly.

In May 2025 it was confirmed that the Commission planned to adopt a “quick fix” delegated act.

In a more recent update, the Commission adopted targeted “quick fix” amendments to the first set of European Sustainability Reporting Standards (ESRS) in July 2025. This will reduce burden and increase certainty for companies that had to start reporting for financial year 2024 (commonly referred to as “wave one” companies).

For the full ‘quick fix’ press release, see here.

For the full breakdown of the ‘quick fix’ see here.

For a timeline of the Omnibus simplification rules, see here from Linklater.

Importantly, in a time when reporting requirements are putting a strain on already over-stretched ESG teams, or those fulfilling these duties alongside a non-ESG related role, Edouard noted that “there will be at least 25% less data requirements… more quantitative, less narrative”, as a result of the new CSRD reporting rules.

In July 2025, EFRAG published its analysis of 656 CSRD-aligned sustainability statements. Only 10% of companies identified all 10 topical ESRS standards as material, with Climate Change (E1), Own Workforce (S1), and Business Conduct (G1) being the most commonly disclosed. The report also highlighted gaps in stakeholder engagement and underreporting of biodiversity and internal carbon pricing.

Unlike large corporations, SMEs are unlikely to have a dedicated sustainability teams or the resources to produce tailored ESG reports for every request they receive.

In their guide to the VSME Standard, Greenly outline how, recognising this burden, “the European Commission tasked the European Financial Reporting Advisory Group (EFRAG) with developing a voluntary reporting framework specifically for non-listed SMEs.”

Alexander explained that if you’re compliant with the VSME standard, this will put you in good stead to comply with CSRD, or helping those larger companies whose supply chain you’re a part of- thus remaining an attractive business partner to larger companies or listed SMEs who must comply with CSRD in full- as it details similar data points.

The importance of stakeholder engagement and materiality assessments was also emphasized. Mary O’Sullivan, Director of European & International Markets at Ad Net Zero, advised that “understanding their perspectives is a core part of the maturity assessment” and encouraged agencies to “start measuring, start looking at what you’re doing already, and try to grow on that.”

The session made clear that while CSRD compliance may seem complex, early preparation and alignment with VSME can provide a manageable and strategic entry point for agencies and suppliers.

You can read more about the VSME, its accompanying taxonomies, and access 2 series of educational videos on the content of the standard from EFRAG here.

On 30 July 2025 the European Commission adopted a recommendation for a voluntary sustainability reporting standard for SMEs. Developed by EFRAG, the standard aims to ease the reporting burden for smaller businesses and improve consistency across value chains. It also acts as a “value-chain cap” to protect SMEs from excessive data requests.

Supporters can access the full recommendation here and the accompanying Q&A here.

US Legislation

We heard from a panel of experts including Dr. Bill Wescott, Managing Partner at Brain Oxygen, Corinne Hanson, VP of Sustainability at Green Places, and Jonathan Storper, Partner at Hanson Bridgett LLP, a leader in corporate law and sustainability, who provided a comprehensive update on the evolving US regulatory landscape.

While federal-level progress remains slow, the speakers emphasized that state-level legislation and litigation risks are rapidly increasing, and businesses must be proactive in preparing for compliance.

Bill reinforced the growing link between climate and financial risk, stating that “there’s a basic equation: climate risk is financial risk. And people care about financial risk.”

On the topic of green claims, Jonathan warned that “if you say you are green… you better be willing to back it up [with] science and evidence. Otherwise, a business may sue you… suggesting that by making that claim without being able to back it up, it gives you an unfair advantage.”

This is particularly relevant in light of California’s Business and Professions Code 17200, also known as California’s Unfair Competition Law (“UCL”), which, as noted by Brown & Charbonneau LLP “prohibits unfair, deceptive, untrue or misleading advertising, in the name of consumer protection”. Jonathan cited this statute directly, noting that it is frequently used to challenge vague or unverified environmental claims under the banner of greenwashing

Corinne touched on the SEC’s proposed climate disclosure rules, which are still pending finalisation. As she explained, “We saw a rollback of the SEC climate disclosure rules, which was a federal rule that required companies to disclose their carbon emissions across scopes one, two, and three. […] This piece of regulation is halted in full. It was voluntarily stayed originally, and we do not expect this to move forward in the Trump administration.”

This is reinforced by a report from KPMG in 2024, which stated that “just a month after releasing its much-anticipated new rules on climate reporting, the Securities and Exchange Commission (SEC) has now paused the implementation after being sued by 25 states and other entities”.

“The future of the Rules remains uncertain, and under several potential scenarios, the Rules – or a variation thereof – could be revived by a future administration. Climate-related matters may represent information that is “material” to shareholders and should be evaluated on a case-by-case basis for inclusion in public company filings.” Relating these ongoings to external laws, DLA Piper outline how “disclosure of climate-related financial risks and greenhouse gas emissions information may be required under international or state laws, such as the European Union’s CSRD; California’s SB-253, the Climate Corporate Data Accountability Act; California’s SB-261, the Climate-Related Financial Risk Act; or similar laws passed by other US states”.

You can watch a trailer of this session on our YouTube channel here.

For more information about joining Ad Net Zero as a supporter, to gain access to attending sessions like these, and to access exclusive resources, please contact the team at hello@adnetzero.com.